Central banks worldwide have echoed a common mantra: “higher for longer”, to reflect their stance on maintaining high interest rates, to combat inflation. While most countries are grappling with persistent increases in commodity prices, the drivers of inflation can vary from one nation to another.

For countries like Nigeria and Turkey, inflation often goes hand in hand with local currency depreciation.

This raises an intriguing question: What's the connection between exchange rates, inflation rates, and interest rates?

One thing's for sure – they all have a significant impact on people's quality of life within an economy.

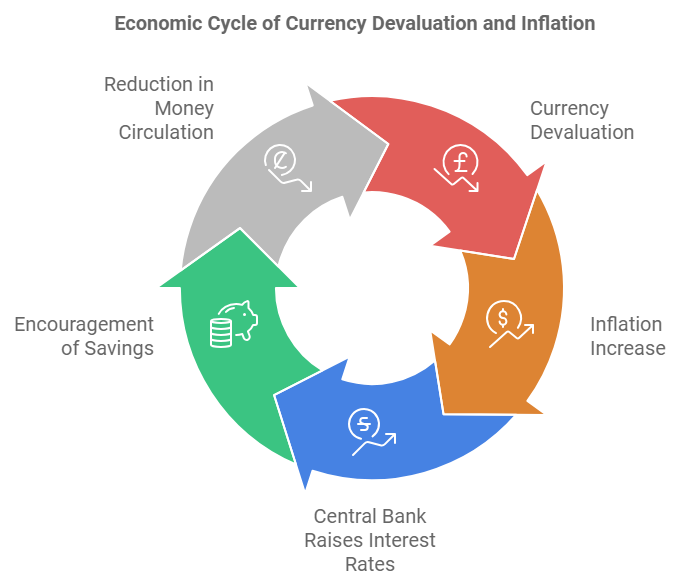

Here's the gist: When a domestic currency loses value against a foreign currency, it often leads to inflation – that is, an increase in the prices of goods and services. To tackle this inflation, central banks typically raise interest rates. This move encourages savings and aims to reduce the amount of money circulating in the economy.

But you might be wondering:

What causes a domestic currency to lose value against another currency?

How exactly does currency depreciation lead to inflation?

And how does hiking up interest rates help tame inflation?

Let’s explore that together. Or you can jump to the conclusion : )

What Causes a Domestic Currency to Depreciate Against a Foreign Currency?

We often hear that when a country imports more than it exports, its currency can lose value against foreign currencies. But why is that? The answer is the demand and supply of currency in the foreign exchange market.

High Exports, Low Imports, and a Struggling Local Currency

When a country imports more than it exports, it creates a high demand for foreign currency in the foreign exchange market, and a low demand for its local currency too. This is also known as trade imbalance. Invariably, this imbalance pushes up the exchange rate, making the local currency less valuable. But hold on, there’s more to this story!

Various economic factors can cause a local currency to lose its mojo. One of these factors is a country’s debt profile, also known as the national debt. It's essentially the IOUs a government has racked up with its creditors.

When governments make their budget for a fiscal year, the money that would finance the spending in the budget often comes from 3 places–money earned from economic activities (e.g. Taxes), money printed by the monetary authority, and money borrowed from creditors. These creditors could be multilateral organizations like IMF and World Bank, investment management firms like Abrdn and Greylock Capital Management, or everyday folks buying government treasury bills.

Now, if a country consistently spends more than it earns, it's running a deficit. Over time, these deficits pile up like dirty laundry, becoming the national debt. A country drowning in debt? That's a red flag for investors.

Debt and Other Woes

Imagine you're an investor considering buying government bonds. If the country's debt is sky-high, you'd probably want a higher interest rate to make it worth your while, right? It's like charging your unreliable friend extra when they borrow money – you need to cover your bases!

But it doesn't stop there. Business owners and investors looking to set up shop in a country with high debt might think twice about holding their assets in the local currency. They might prefer to keep their money in a more stable currency to avoid exchange rate-related financial risks. Inadvertently, this creates more demand for foreign currency.

In summary, currency depreciation is a complex dance influenced by trade imbalances, national debt, and investor sentiment. When a country imports more than it exports, its currency can weaken due to increased demand for foreign currencies. High national debt adds fuel to the fire, making investors nervous and potentially driving them towards more stable foreign currencies. These factors create a perfect storm that can send a domestic currency tumbling against its foreign counterparts.

How Does Domestic Currency Depreciation Lead to Inflation?

When a country's currency depreciates, it can set off a chain reaction that ultimately leads to inflation. But the effects aren't always straightforward, and there can be some surprising consequencesLet's break it down.

First off, when your domestic currency loses value, imports become more expensive. This is because it takes more domestic currency to purchase foreign goods and services. As businesses pass on these higher costs to consumers, inflation can result. Another thing is a weaker currency can also put upward pressure on domestic prices. For example, if local businesses see increased demand for their products due to exports becoming more competitive, they may raise prices to capitalize on the higher demand.

Lastly, A depreciating currency can increase the burden of government debt, especially if the debt is denominated in foreign currency. This leaves the government in a tight spot, with less money available for essential services and infrastructure improvements that could benefit its citizens. The government might need to print more domestic currency for these essential services and to facilitate economic activities, in order to repay the foreign debt, which can put pressure on the money supply and contribute to inflation.

So, What Does This Mean?

You might think this would be all bad news, but here's where it gets interesting. The higher cost of borrowing for the government can have an unexpected silver lining. It can make domestic investments more attractive to both local and foreign investors. Why? Well, if the government is offering higher interest rates to borrow money, other investments in the country might also offer better returns.

This increased investment can actually boost demand for the local currency, potentially slowing or even reversing its depreciation. It's like a financial tug-of-war, with various forces pulling in different directions.

How Does Raising the Interest Rate Cause Inflation to Reduce?

When a country raises its interest rate, it encourages consumers to increase savings and reduces the supply of money.

In addition to some of the causes of inflation mentioned earlier, one other reason is that there is too much money in circulation chasing too few goods. But where does all this extra money come from? Well, there are a few culprits:

Governments printing money like there's no tomorrow to cover budget deficits. It's tempting, sure, but it's like trying to fill a leaky bucket – eventually, you'll flood the whole room.

Economic stimulus packages, like the ones many Western countries rolled out during the COVID-19 pandemic. While these can be a lifeline in tough times, they can also lead to an unexpected money surplus.

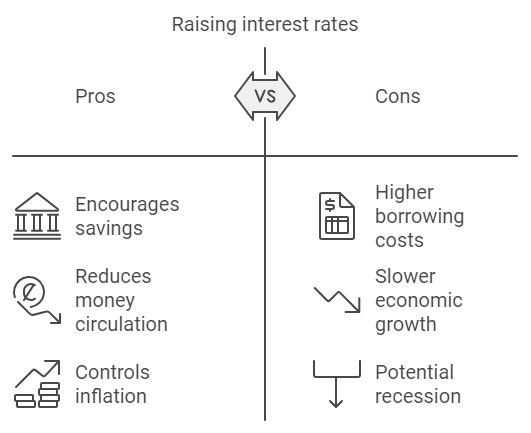

Here's where raising interest rates comes in like a financial superhero. By making it more rewarding to save and more expensive to borrow, higher interest rates effectively reduce the amount of money zipping around the economy. It's like turning down the volume on a too-loud stereo – suddenly, everything feels a bit more balanced.

But (there's always a but, isn't there?), this financial tune-up doesn't come without its own set of challenges. When interest rates climb, it's not just individuals feeling the pinch. Governments, businesses, and anyone with existing loans suddenly find themselves forking over more cash to cover their interest payments. It's a bit like the economy is going on a diet – beneficial in the long run, but not always comfortable in the moment.

So raising interest rates is like applying the brakes to an economy that's racing a bit too fast. It encourages saving, discourages excessive spending and borrowing, and helps bring the amount of money in circulation back to a more manageable level. While it can lead to some short-term discomfort, it's often a necessary step to keep inflation from spiraling out of control. The key is finding that sweet spot where the economy runs smoothly without overheating or stalling out completely. It's a delicate balancing act, but when done right, it helps ensure a healthier, more stable financial future for everyone."

Conclusion

Let's take a moment to put all the pieces together and see the big picture.

Imagine the economy as a grand ballroom, with interest rates, exchange rates, and inflation all engaged in an intricate dance. Here's how the steps play out:

When a country's central bank decides to turn up the music by raising interest rates, it sets off a chain reaction. Suddenly, saving becomes more attractive than spending, and people start tucking away their cash. This leads to less money circulating around the economy, which helps cool down inflation.

Higher interest rates don't just affect the locals – they catch the eye of foreign investors too. These investors see the potential for better returns and start pouring money into the country. As more foreign investors join the dance, they need local currency to invest. This increased demand gives the domestic currency a boost, strengthening its exchange rate.

With less money circulating and a stronger currency, inflation starts to lose its steam. Imported goods become cheaper, and the overall price level in the economy stabilizes.

But here's the kicker – this dance is all about balance. If interest rates stay too high for too long, it might slow down economic growth. If they're too low, inflation might run wild. The key is finding that sweet spot where all our dancers – interest rates, exchange rates, and inflation – move in harmony.

0 comments