Inflation is the continuous increase in the general price of goods and services in an economy. What this also means, is a continuous increase in the general cost of living in a country.

Source: DAWN.com

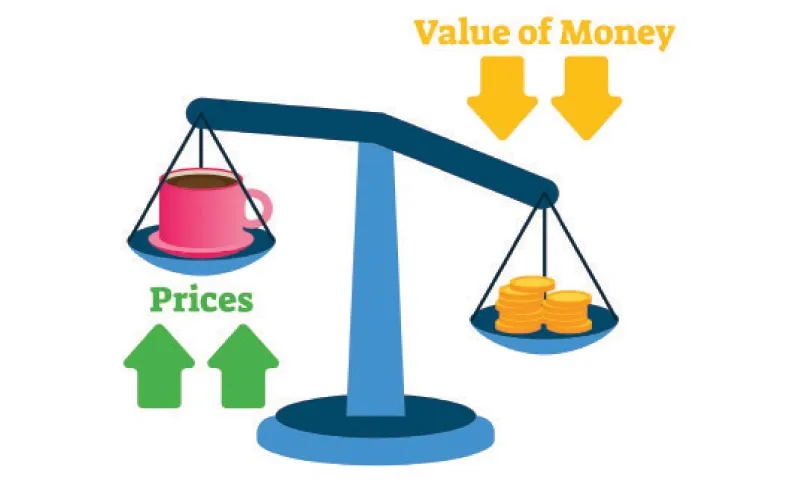

Inflation can also be described as a steady and continuous decline in the purchasing power of the currency of a country, over a specified period of time.

Inflation rate is the rate of percentage increase in the general price of goods and services in an economy. The inflation rate explains in percentage, how much the general price of goods and services has increased in the measured period when compared to a previous period.

The inflation rate also shows in percentage, the degree to which the currency of a country can buy fewer goods and services over time when compared to a previous period. This is also known as the declining purchasing power of a country’s currency.

How is inflation measured or calculated?

Inflation is measured by comparing the current prices of a basket of selected common goods and services, to its previous prices. The basket of selected common goods is used to create a price index.

A Price index is a weighted average of the prices of a selected number of goods and services in a region, over a specified period of time. Examples of price indexes are the Consumer Price Index (CPI), Producer Price Index (PPI), Personal Consumption Expenditures (PCE), etc.

The Consumer Price Index (CPI) is the most commonly used price index by statistical agencies to determine changes in prices of common goods and services.

What are the causes of inflation?

Inflation will happen when the demand for certain goods and services is greater than the economy’s ability to produce and meet the demand for those goods and services. When demand is higher than supply, the general price for those goods and services will increase. This is also known as Demand-pull inflation.

Another cause of inflation could be an increase in the general cost of factors of production such as raw materials, wages, or government restrictions. The extra costs incurred in the production and delivery of the goods and services are added to the final price of the product, thereby causing the general price to increase. This is also known as Cost-push inflation.

One other major cause of inflation is the increase in the supply of money in an economy. The various ways in which the money supply in an economy can be increased include; printing and giving money away to citizens as grants; through currency devaluation; or when the central bank loans money to financial institutions by purchasing bonds or securities in the secondary market.

Is inflation good or bad?

Inflation is good when it helps to boost consumer demand and consumption, thus driving economic productivity and growth.

Inflation can also be considered to be good for borrowers because rising inflation makes it easier to repay a debt. For example, say one’s employer increases one’s salary by 20% to combat inflation, it makes it easier to repay an old debt or loan.

Inflation is bad when high price variation leads to increased uncertainty about the economic prospects of the country. This usually makes it difficult for firms to make decisions on whether to invest or hoard their resources.

Another negative implication of inflation is that because it makes money saved today to be less valuable tomorrow, it discourages savings, and it erodes the consumers purchasing power.

How does the government tackle inflation?

Governments often use inflation to drive economic productivity when there is unused labor or available resources and the economy is not running at its optimum capacity. This is based on the John Maynard Keynes theory, that some inflation can help to prevent the delay of consumption–a scenario that often occurs in over-productive economies, where consumers learn to hold off their purchases hoping for prices to fall. This is also called the paradox of thrift

However, when inflation is too high, it fosters uncertainty and hardship in the economy. Thus Governments use some of the following measures to combat inflation;

- Controlling prices by implementing compulsory price limits for certain products

- Increasing interest rates to reduce consumer and business spending and encouraging more savings

- Controlling the supply of money by halting the printing of money and reselling government or private securities purchased in the secondary market

- Increasing income tax so as to reduce spending or demand.

0 comments