Fifty-three African Heads of State gathered in Beijing from the 4th to the 6th of September, 2024, at the table of President Xi Jinping to discuss continued China-Africa cooperation. This big meeting, called the Forum on China-Africa Cooperation (or FOCAC for short), has got people talking – and not everyone's saying the same thing.

Some folks are excited, others are worried, and many are just plain curious about what it all means. The big headline? China is promising to chip in over $50 billion to help African countries over the next three years. That's a lot of zeros!

Now, you might be wondering, "What's the deal with this FOCAC thing anyway?" Well, think of it like a regular check-in between old friends. Every three years since 2000, China and African countries have been getting together to plan how they can help each other out.

According to the Chinese Ministry of Foreign Affairs, the fundamental principles behind the Forum have been to plan and build mutually beneficial relationships between China and the African region. In the last 24 years, 8 editions of the FOCAC have been held, with the last one held in Dakar, Senegal in 2021.

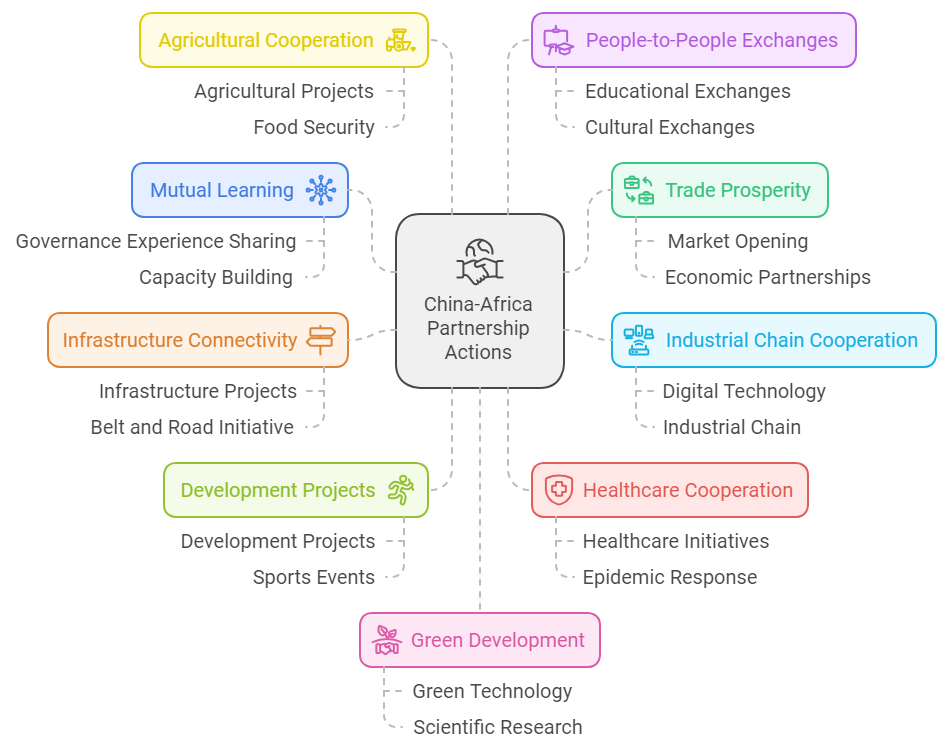

The 9th edition of the FOCAC was themed "Joining Hands to Advance Modernization and Build a Higher-Level China-Africa Community with a Shared Future". In plain English, it means China wants to team up with Africa to implement 10 partnership actions over the next three years, aimed at deepening China-Africa cooperation and spearheading modernization efforts in the Global South. We're talking about everything from boosting trade and building roads to sharing farming tips and working on green energy. China's even offering to lend a hand with sports events and healthcare.

Source: Author's illustration via napkin.ai

To support these initiatives, China pledges to provide 360 billion yuan (roughly $50.7 billion) in financial support over the next three years, including credit lines, various forms of assistance, and investments by Chinese companies in Africa.

But here's where things get a bit tricky. Some people are raising eyebrows about this whole plan. They're worried about countries like Zambia and Djibouti, which already owe China a lot of money. Others are questioning whether all those roads and buildings China's been helping to build in Africa are really such a good deal. And then there's the issue of trade – some folks think China's getting a better end of the bargain when it comes to trade relations with African countries.

So let’s take a look into some of these questions and break down why they matter to everyday people like you and me. It's a big, complex issue, but understanding it helps us see how decisions made in faraway conference rooms can end up affecting lives all over the world.

Or you can jump to the conclusion : )

Debt Crisis in African Countries

Imagine you're trying to renovate your house, but you've already maxed out your credit cards and taken out a second mortgage. Now the bank's offering you another loan, but you're barely keeping up with your current payments. That's the kind of situation many African countries find themselves in right now, but on a much bigger scale.

African nations have been borrowing money to build roads, rails, dams, and grow their economies. Think of it as taking out a loan to start a business – you hope it'll pay off in the long run. But here's the catch: the debt pile has grown significantly.

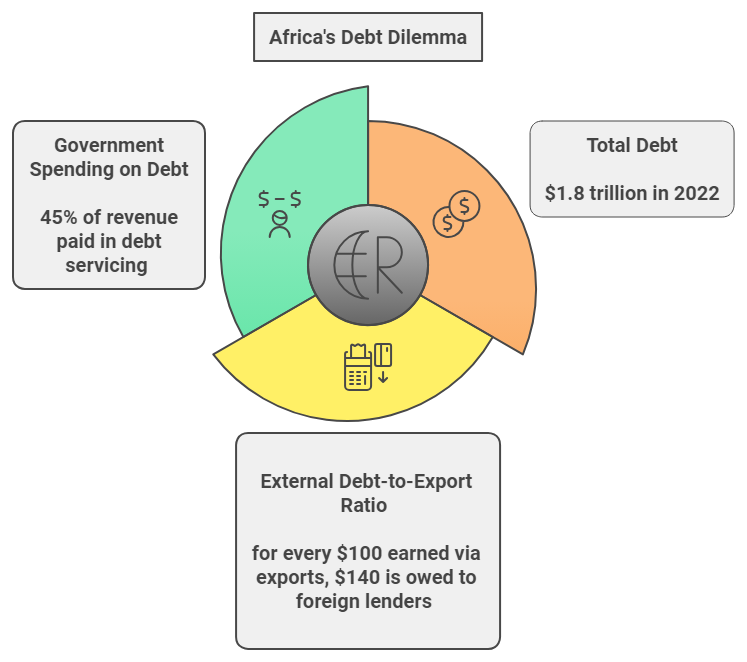

Source: Author's illustration via napkin.ai

Let's break it down with some numbers (don't worry, we'll keep it simple):

African countries owed a whopping $1.8 trillion in 2022, increasing by 183% since 2010. That's nearly triple what they owed just over a decade ago!

Concurrently, the external debt-to-export ratio also increased from 74.5% in 2010 to 140% in 2022. This means that for every $100 African countries earn from selling stuff to other countries, they now owe $140 to foreign lenders. It's like your credit card bill growing faster than your paycheck.

The World Bank also reported that more than half of countries in Africa are facing unsustainable debt burdens, with governments paying over 45% of their revenue to service debts. Nine African countries started 2024 in debt distress (basically saying “sorry, we can’t pay right now”), while fifteen countries are at a high risk of distress and fourteen more are at moderate risk.

Some countries, like Ethiopia, Djibouti, Ghana, and Zambia, have already defaulted on their payments in 2024. Chad had to sit down with the people it owes money to work out a new payment plan and preserve the sustainability of its debt in the event of a slump in oil prices or any other financing challenge.

Now, here's the million-dollar question: Should African countries keep borrowing money? It's a tough call. On one hand, they need funds to grow and improve life for their citizens. On the other hand, people are starting to wonder if all this borrowing is really helping. After all, if you keep taking out loans but your life isn't getting better, at some point you've got to ask: Is this really worth it?

This debt dilemma is leaving many African leaders, citizens, and international observers scratching their heads. It's a complex issue with no easy answers, but one thing's for sure – it's going to be a hot topic in discussions about Africa's future for years to come.

Criticisms Against China’s Financial Aid and Infrastructure Development in Africa

China is offering a mix of goodies to African countries–a financial aid package that comprises credit lines used to facilitate infrastructure projects, technical cooperation, human resource development cooperation, volunteer programs, and humanitarian aid. Sounds great, right? But here's the problem: it's not free money. It's more like a credit card with some strings attached.

First up, these aids are repayable long-term loans. Compared to loans from big global banks like the World Bank, China's rates are higher. Plus, China wants its money back faster - in about 10 years, while other lenders might give you 35 years to pay up.

Now, what happens if an African country can't pay? This is where things get tricky. China doesn't like to play by the usual rules of forgiving debt. Instead, they prefer one-on-one talks behind closed doors, and avoid reducing the principal owed, instead favoring extended repayment period. Sometimes, they might ask to take over management of national infrastructures such as airports, and broadcasting stations when there are debt defaults. This can make sorting out debt problems a real headache, as Chad found out recently when its Chinese lenders were accused of unnecessarily prolonging negotiations.

Here's another eyebrow-raiser: when China lends money for a project, they often insist that Chinese companies do the work. It's like if your neighbor lent you money to fix your roof, but only if their cousin's roofing company did the job. This can lead to some pretty inflated prices. Take Kenya's new Standard Gauge Railway project, for example. The cost shot up by almost 50% in just three years! The Kenya Court of Appeal even found evidence of cost manipulation and procurement malpractice.

This "You borrow from us, you hire our guys" deal has contributed to the dominance of Chinese construction firms in Africa, with a study carried out by SOAS University of London revealing that 80% of major international contractors working on significant construction projects in Ethiopia in 2017 were Chinese companies.

Last but not least, there's the secrecy. China likes to keep the details of these loans under wraps. It's like borrowing money from a friend who insists you can't tell anyone about it. This lack of openness makes other international lenders nervous and can make it hard for the public to know what's really going on, potentially contributing to corruption.

So, while China's offering a helping hand to Africa, some folks are wondering if it's really as helpful as it seems. It's a complex issue with no easy answers, but one thing's for sure - it's got people talking!

The Imbalance of Trade between China and Africa

A recent research study by Ndzendze & Mulugeta (2023) highlights a significant disparity in the China-Africa trade relationship. When China and Africa make deals, it seems China often comes out on top. They're bringing in their own equipment, sending over their top people, and calling the shots on big projects. Meanwhile, African countries are mostly providing the muscle and helping navigate local red tape. The problem? Africa's not really picking up new skills or technical know-how from these projects.

Now, you'd think with all these deals, both sides would be benefiting equally, right? Well, not quite. The numbers tell a different story. In the first half of 2024, Africa sold about $60 billion worth of raw minerals to China - that's up 14% from last year. Sounds good, doesn't it? But here's the kicker: China sold nearly $85 billion worth of goods to Africa in the same period. Even though that's actually a bit less than last year, it's still a whole lot more than what they're buying from Africa.

So why the sudden boost in Africa's sales? Experts say it's because they're digging up more minerals, prices for raw materials went up, and African currencies got a bit weaker. But they’ve however warned us not to get too excited. This boost might not stick around for long.

The real issue is that this trade relationship hasn't really changed much over the last ten years. China promised to help Africa build up its industries, but we're still seeing the same old pattern. Africa's selling raw materials - think minerals and farm products - while buying finished goods like phones, machines, and cars from China.

It almost feels like Africa is stuck supplying ingredients while China is cooking up the final dish. Without a smart plan to shake things up, Africa might keep struggling to develop its own industries and create a more diverse economy.

So, while the numbers might look good on paper right now, the big question remains: How can Africa turn this relationship into something that really helps it grow in the long run?

It's a tough nut to crack, but it's one that many African leaders and economists are scratching their heads over.

Conclusion

The 2024 China-Africa Summit was a big deal. It's the 9th time these countries have gotten together to talk shop, and China's offering a whopping $50.7 billion to help out African countries over the next three years. That's a lot of money, and it shows China's still pretty interested in what's happening in Africa. But it's not all smooth sailing.

China's got plans for everything from trade to farming to security. Sounds great on paper, but we've got to look at how well these ideas actually work in real life.

The thing is; a lot of African countries are drowning in debt. We're talking $1.8 trillion as of 2022. Some countries can't even keep up with their payments anymore. So when China offers more loans, it's like offering a credit card to someone who's already maxed out theirs.

Then there's how China does business in Africa. Their loans often come with higher interest rates and shorter payback times. Plus, they like to use their own companies for big projects, which doesn't always sit well with locals. And they're not big on sharing the details of these deals, which can make things tricky.

Let's not forget about trade. Even though China says it wants to help Africa build its own industries, not much has changed. Africa is still mostly selling raw materials and buying finished products from China. It's not exactly a balanced relationship.

So, what now? African countries need to get smart about this. African nations must develop a cohesive strategy that prioritizes their own interests and development goals. This strategy should focus on:

Debt sustainability: Carefully evaluating the terms of new loans and prioritizing projects with clear economic returns.

Transparency: Pushing for open and competitive bidding processes and full disclosure of loan terms.

Technology and skills transfer: Negotiating agreements that ensure meaningful capacity building and knowledge transfer to local populations.

Industrial development: Focusing on value-added production and diversification of exports to reduce dependence on raw material exports.

Regional cooperation: Leveraging collective bargaining power through African regional bodies to negotiate more favorable terms with China and other international partners.

Domestic resource mobilization: Strengthening tax systems and promoting domestic savings to reduce reliance on external financing.

China's interest in Africa could be a good thing, but African leaders need to make sure it's good for their people too. They need to think long-term and make decisions that will help their countries grow and stand on their own two feet.

This is a turning point for Africa. The choices made now will affect the continent for years to come. It's time for African countries to take control of their own story, use partnerships like the one with China wisely, and look out for their own interests. If they play their cards right, Africa could see some real progress and prosperity. But it's going to take some smart thinking and teamwork to get there.

0 comments